In this Article

Finance Education and Career Guide

Comprehensive Guide to Finance Degrees

Finance includes a number of careers, and the right degree option often depends on which career most interests you.

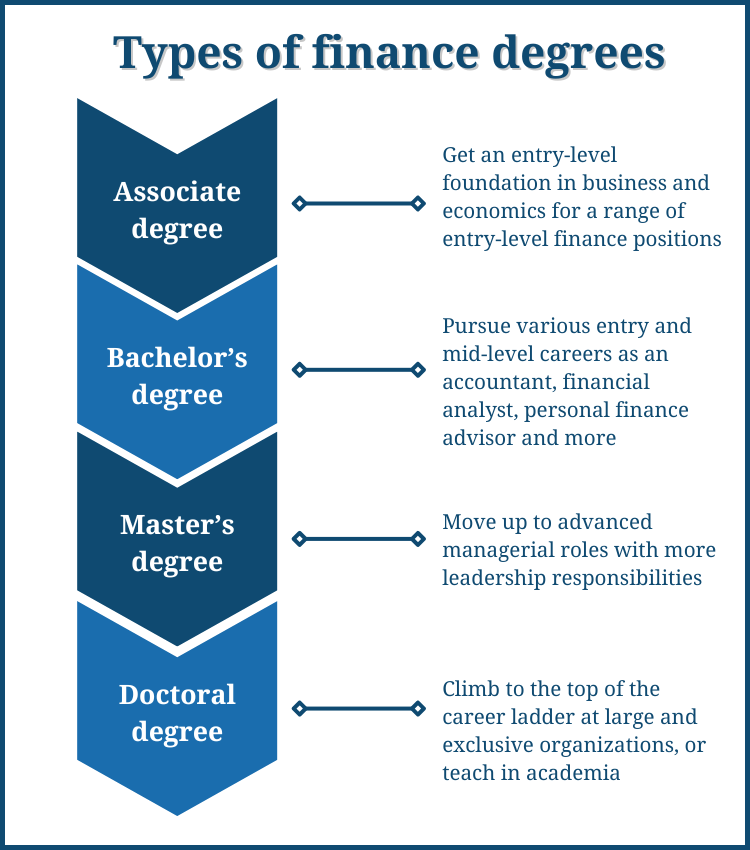

Factors to consider when you're comparing degrees include your budget and how much time you're able to devote to your education. Financial degrees are available from the associate to doctoral level, so you'll have several paths to choose from.

Bachelor-level degrees are the most common education route in many financial careers. However, master's degrees are becoming more standard for some financial jobs. For instance, if you're interested in working as a financial analyst for high-wealth clients, or if your career goals include managing the finances at a large company, a master's degree might be your best bet.

"Right now, the Master in Business Administration (MBA) is becoming the new gold standard," says Stanford Nix, MBA, a venture capitalist and managing partner of The Nix Organization. "I think that in 20 years, it will be the norm, and having a PhD will be the huge differentiator."

What Finance Degrees are Available?

Aspiring financial professionals have multiple degree options to choose from. You may be able to get started by jumping into a two-year associate degree program and then taking on an entry-level role, or you can set your sights on earning an advanced degree such as an MBA before you enter the financial workforce. No matter which path you choose, your financial education may cover core topics such as economics, accounting, and investment management and should prepare you for a financial career.

"A two or four-year finance degree will put you on equal footing with others when you get started," explains Cliff Auerswald, president of All Reverse Mortgage, Inc. "With those degrees, you'll be well versed in topics such as basic economics, business accounting, financial analysis, and current real estate legislation. An advanced degree in finance will put you ahead."

Associate Degrees in Finance

About the degree: You can earn an associate degree in finance at many community colleges and online schools. You might see this degree listed as an Associate in Finance, or an Associate in Financial Management depending on the school you attend. Some schools might also offer the option of associate degrees in business with concentrations in finance.

How long it takes: Two years

What you'll study: You'll take some core classes in college-level writing, math, and science, as well as take financial courses such as economics, risk management, financial accounting, investment management, and financial analysis.

Potential jobs: Students who've earned an associate degree can look into positions such as bookkeeper, associate financial analyst, financial clerk, accounting associate, or loan officer.

Bachelor's in Finance

About the degree: Bachelor's degrees in finance are typically either Bachelor of Science in Finance or Bachelor of Business Administration in Finance. Some schools might also offer Bachelor of Art in Finance degrees, but this option is less common. The general format of the degree programs will be the same no matter which route you choose. However, if you want to pursue a business-focused financial career, it can be a good idea to look into schools with Bachelor of Business Administration in Finance degrees.

How long it takes: Four years

What you'll study: You'll take core courses to earn your degree in areas such as math, English, science, and humanities. In general, a Bachelor of Science will require more core courses in science and math, while a Bachelor of Arts will require more courses in liberal arts subjects such as social sciences and English. A Bachelor of Business Administration will require more business-focused classes. In addition to your core classes, all bachelor-level financial degrees will require you to take classes such as economics, risk management, business finance, investment management, marketing, statistics, corporate accounting, stock market fundamentals, and wealth management.

Potential jobs: Graduates of bachelor's degree programs can pursue jobs such as accountant, financial analyst, budget analyst, investment banker, and personal financial advisor.

Master's Degree

About the degree: There are two popular graduate-level degrees for financial professionals. You can choose to earn a Master of Business Administration (MBA) with a concentration in finance, or a Master in Finance. An MBA can prepare you for a wide range of business roles with a financial focus, while a Master of Finance degree will prepare for high-level financial positions.

How long it takes: Two years in addition to your bachelor's degree

What you'll study: An MBA program will cover business topics and financial topics. You'll take courses on subjects such as business ethics, management, financial planning, marketing, accounting, organizational behavior, operations, and business accountability. A master's degree in finance will be focused on finance, and your courses will include economics, accounting, financial planning, corporate finance, investment and portfolio management, financial regulation, and financial regulation.

Potential jobs: You'll be prepared for advanced roles with an MBA or master's degree in finance. This includes job titles such as financial manager, financial analyst, auditor, controller, credit manager, and chief financial officer.

Doctoral Degree in Finance

About the degree: At the doctoral level, students can choose from a Doctor of Business Administration (DBA) with a concentration in finance, or a PhD in finance. A DBA will concentrate on more professionally oriented courses, while a PhD's focus will be on research and academically oriented courses.

How long it takes: Two to three years in addition to your master's degree

What you'll study: In a DBA program, you'll take high-level business courses such as leadership ethics, management strategy, global economics, corporate governance, business intelligence, financial management, and financial strategy. In a PhD in finance program, your courses will include economics, econometrics, advanced statistics, financial decision making, and advanced accounting theory.

Potential jobs: Doctoral degrees can allow you to apply for roles at large or exclusive employers where you might manage teams of financial professionals. You can also open a financial agency and take on your own clients. Additionally, a PhD in finance allows you to teach finance to aspiring financial and business professionals.

What About Certification?

There are some certifications available for financial professionals. None of these certifications are state-mandated; however, they're still very important to some employers. Often, employers will only hire candidates who have achieved certification. Additionally, earning certification can boost your salary and help advance your career.

Financial professions where certification is encouraged include:

Greg Wilson, a Chartered Financial Analyst with more than two decades of experience in the financial industry, has both a CFA and a CFP and says that benefits go beyond the salary boost he received after earning them.

"These designations not only are nice letters to have, but I found that studying for them legitimately increases your knowledge base and shortens your learning curve," he says. "I am a big advocate of both."

Do I Need a License to Work in Finance?

Most financial jobs don't have any licensure requirements. However, you will need a license if you're interested in selling real estate or insurance. The requirements for licensure in these professions is set by each state. You'll need to meet your state's requirements and apply for licensure with the appropriate state agency. You'll need to keep your license current to continue selling real estate or insurance policies in your state.

Are Finance Degree Programs Offered Online?

It's very common for financial degrees to be offered as online programs. Many of these programs can be completed 100% online and allow you to work at your own pace. You'll be able to complete your courses in the evenings, weekends, or whenever works best for you. Some programs do have capstone or internship requirements that will need to be completed in person. This isn't always the case, and it's more common in MBA, DBA, and PhD programs than in other degree paths.

Programs and Schools: What to Look For

The right degree program for you should fit your specific goals, learning style, budget, and lifestyle.

It's important to make sure any schools and programs that you're considering are accredited. Accreditation is an important measure of quality and offers assurance that you can count on your education to serve as a strong foundation for your financial career.

There are two additional benefits to accreditation you should know about. The first is that credits from an accredited school can be transferred to other colleges and universities. This can save you time and money if you decide to transfer schools or advance your education down the road. The second benefit is that attending an accredited school will allow you to use federal student aid such as loans and grants to help pay for education.

Finance Industry Salary and Job Outlook

Your salary as a financial professional may depend on location, certification, and exact job title. Your education level can also make a big difference in your salary. Going from an associate or bachelor's degree to a master's degree may help you earn more.

Financial professionals have a promising job outlook says the U.S. Bureau of Labor Statistics, with financial managers anticipating a 17% job growth through 2030. This may be due to the need for experts who can manage money and help companies and individuals develop strong financial plans. Plus, as new technology and developments in the financial field evolve, different types of roles may be included in the profession to help support financial officers and analysts.